Share this post:

On Monday, December 1st, the conversation around Ethical Finance took center stage at the European Parliament, in an event hosted by the Social Economy Intergroup. The occasion marked the public launch of the 8th Report on Ethical Finance, “Capital for Common Good: Ethical Banks and the Social Economy for the Future of Europe,” published by FEBEA, Fondazione Finanza Ética, and its Spanish counterpart, Fundación Finanzas Éticas. The presentation brought together more than 100 participants, including policymakers, sector experts, and key stakeholders.

The event featured interventions from MEPs Mravillas Abadía Jover and Irene Tinagli, co-chairs of the Social Economy Intergroup, and a high-level round table with speakers such as Ruth Parseman, Director at DG Employment, and Gelsomina Vigliotti, Vice-President of the EIB. Additional contributions came from FEBEA Secretary General Daniel Sorrosal, GABV Executive Director Martin Rohner and Social Economy Europe Director Sarah de Heusch.

Presenting this report within the halls of the European Parliament marks an important milestone: it underscores the growing recognition of Ethical Finance as a viable, effective, robust and secure financial model and reinforces its role as a key partner in strengthening Europe’s Social Economy.

As FEBEA’s President Pedro Sasia remarked,

“The challenges we face—climate change, inequality, and perhaps above all the fragility of our democracies—demand cooperation, innovation, and trust. They call for a financial system that does more than react to market opportunities, but one that leads and Ethical Finance is ready to assume that role.”

Read the report here.

The report analyzes 2023 data from 24 ethical banks and 107 significant or mainstream banks, and it has been constructed with the collaboration of several universities and European financial networks.

The report is structured in three sections, the first of which presents impact data demonstrating how ethical banks outperform traditional financial institutions in both credit quality and social impact—particularly in areas such as social inclusion and community development.

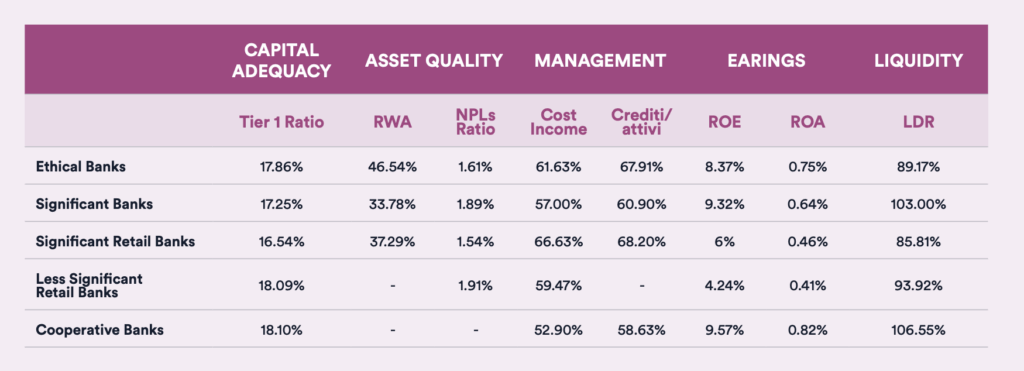

To conduct this comparison, the report employs several analytical frameworks, including a contrast with ESG criteria, the BESGI score (Banks’ Environmental, Social, Governance and Indirect Impacts), and the CAMEL assessment method commonly used by international supervisory authorities.

The findings show that ethical banks maintain capital indicators, credit quality, and operating profitability that match—or in some cases exceed—those of larger mainstream banks. For instance, some key findings show that ethical banks’ loan-to-asset is significantly higher than those of mainstream banks. The same happens with the return on assets, demonstrating that ethical impact goes hand-in-hand with economic sustainability.

This confirms that their assessment model, rooted in social and environmental considerations, allows them to combine financial stability with a strong focus on groups typically underserved by the conventional banking system.

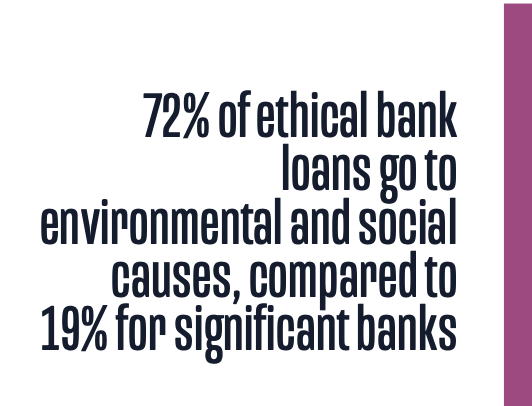

With respect to measurable social and environmental impact, the report finds that 72% of ethical banks’ loans have a positive environmental and social impact compared to 19% of large banks. Furthermore, ethical banks lead in the presence of women in senior roles and the adoption of more widespread exclusion criteria in lending and investment (i.e. exclusion of armaments, fossil fuels, companies involved in human rights violations…).

The report also highlights that 70% of ethical banks’ lending is directed to the social economy, supporting cooperatives, micro-enterprises, and non-profit organisations—a figure far higher than the 19% reported by significant banks. This strategic orientation allows ethical banks to provide credit and tailored financial tools to the social economy, strengthening sectors that play an increasingly central role in Europe’s economic and social landscape.

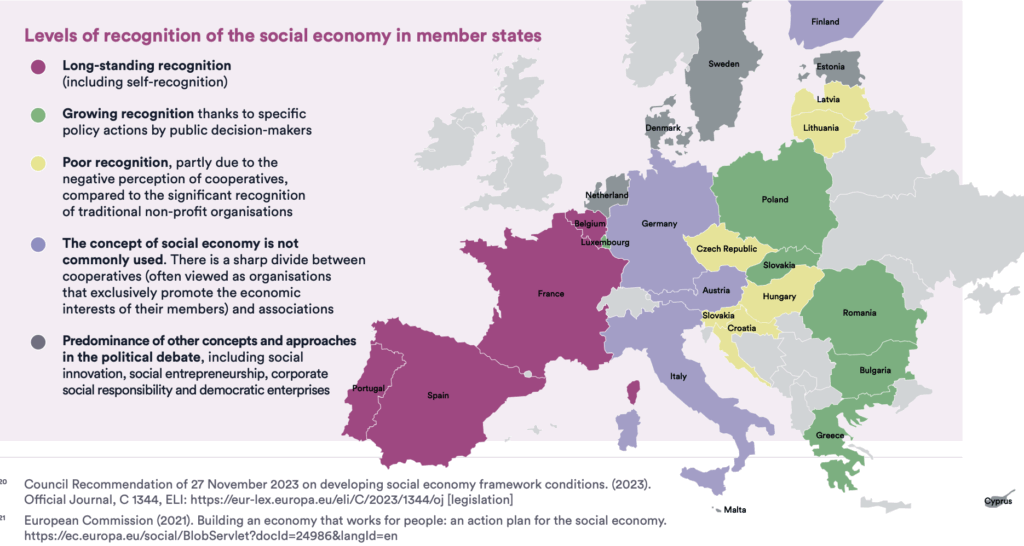

This is why the second chapter of the report focuses on the social economy itself—a model that already encompasses 4.3 million organisations, generates €913 billion in turnover, and employs 11.5 million people, representing 6.3% of the European workforce, a share comparable to that of the automotive industry. It is a rapidly expanding ecosystem, responding to needs unmet by either the state or traditional markets. Over time, it has proven to be a key driver of economic development, social inclusion, and territorial resilience. Investing in the social economy, therefore, means investing in an economic model capable of combining business efficiency with social value, innovation with cohesion, and development with democratic participation.

In summary, the report positions ethical finance as the reference financial infrastructure for the social economy, showing that the relationship between the social economy and ethical finance is not occasional but structural: the social economy provides the field of action, while ethical finance provides the instruments and support, strengthening businesses and enabling access to credit for those often excluded.

The third chapter of the report provides an overview of Europe’s once-ambitious sustainable finance agenda. Initially built on clear environmental standards and broad political consensus, this agenda has weakened sharply in recent years. Early advances on the EU Taxonomy and transparency rules are now being rolled back, most visibly through the 2025 Omnibus Package, which critics say dilutes disclosure requirements and weakens sustainability definitions.

Meanwhile, global finance has retreated from climate pledges. Banks in net-zero alliances continued financing fossil fuels even after the Paris Agreement, and many of these alliances have since fragmented or softened their commitments. Stated by the Banking on Climate Chaos report: “In 2024, global banks walked back many of those climate pledges and significantly increased their fossil fuel financing, including ramping up finance for fossil fuel expansion.” In parallel, a growing push to classify the arms industry as “sustainable” is reshaping Europe’s financial landscape, coinciding with an €800 billion rearmament agenda and proposals that could channel citizens’ savings into defence companies without full transparency.

These shifts risk turning sustainability into an empty label. Ethical finance leaders warn that including weapons or fossil-fuel expansion in ESG products would undermine the credibility of the entire framework. Their call is clear: only strong, transparent, and enforceable rules, paired with real impact, can restore trust in Europe’s sustainability agenda.

The report sets out a series of concrete recommendations for European policymakers to strengthen the social economy and steer financial flows toward ethical and sustainable objectives. Among its key proposals:

The report also issues a strong warning to the European political framework, expressing concern over proposals to classify arms production as “sustainable.” Ethical finance reaffirms that peace, social cohesion and ecological transition must remain the non-negotiable pillars of sustainable finance, stressing that finance is never neutral—and that blurring these boundaries risks turning it into a source of instability rather than progress.