Share this post:

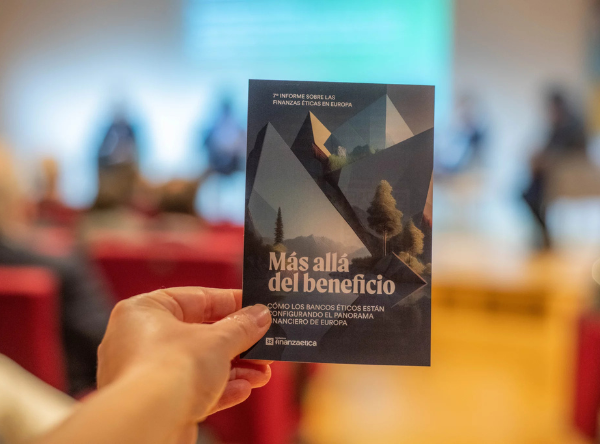

Last 27th of November, Fundación Finanzas Éticas, Fondazione Finanza Etica, and The European Federation of Ethical and Alternative Banks and Financiers (FEBEA) presented the 7th report on Ethical and Value-based Finance in Europe that the three organizations jointly authored.

The report showcases the advancements and resilience of Ethical Banks across Europe, emphasizing their commitment to supporting the real economy, fostering social inclusion, and addressing environmental challenges. This year, the document acquires a strong focus on Social Economy thanks to the collaboration of Social Economy Europe.

The Vice-President of the European Investment Bank (EIB), Gelsomina Vigliotti, who attended the presentation as a speaker, underlined how the EIB relies “on financial intermediaries” like Ethical Banks.

Representatives of the Global Alliance for Banking on Values (GABV), Banca Etica, Social Economy Europe, and FEBEA converged at the event where Peru Sasia, president of FEBEA, underlined: “We are not looking at a fixed image; we are looking at an evolution. We are on a journey.”

The report compares 60 major European banks, directly supervised by the European Central Bank (ECB), with 26 Ethical Banks from GABV and FEBEA using the CAMEL model, analyzing capital, asset quality, management, profitability, and liquidity.

The result shows a picture where Ethical Banks are as solid as traditional banks but show a stronger tendency to support the real economy. Specifically, nearly 70% of Ethical Banks’ assets are allocated to credit for the real economy, compared to only 51.6% for traditional banks, which favor lower-risk financial assets such as government bonds or more speculative instruments.

The preference of traditional banks for financial assets is also reflected in their Return on Equity (ROE). Over the past ten years, Ethical Banks had a significantly higher ROE in five of those years, including a notable difference of +5.85 percentage points in 2013. This was largely because large banks, being more exposed to financial markets, were hit hard by the 2007-2008 crisis and took longer to recover. Ethical Banks, with their lower exposure, maintained a steady ROE, averaging around 5%. However, in the last two years, traditional banks have bounced back and achieved a higher ROE than Ethical Banks.

With the participation of Social Economy Europe in the report this year, the document acquires a strong focus on the role of Social and Solidarity Economy in Europe and its link with Ethical Finance.

Around the relationship between Ethical Finance and Social Economy, Peru Sasia, President of FEBEA, stated: “These connections go beyond the important relationship between provider and client. In fact, we can speak of an isomorphism in the core characteristics of both sectors, as they share a common commitment to social impact, sustainability, and collective well-being.”

“It doesn’t look like the extreme right is going to hinder the path for Social Economy in Europe, but we can’t get too confident,” Juan Antonio Pedreño, President of Social Economy Europe, stated in one of his interventions during the presentation of the report. He also underlined the importance of renewing the Social Economy Intergroup that has been working for the sector since 1990.

After a deferral of the voting for the intergroups, this will take place on the 19th of December, and the Social Economy Intergroup is now joining forces with the Intergroup of Services of General Interest in order to gather the support of the different political groups. So far, S&D and EPP have shown their support for the newly created intergroup, but this will need a third force to come into place.

In the newly created Commission, Roxana Mînzatu, Romanian Executive Vice-President for Social Rights and Skills, Quality Jobs, and Preparedness, has been awarded the competence of Social Economy in her mission letter.

In the words of Mr. Sasia: The lessons from Ethical Finance highlight the relevance of investigating more deeply in at least two directions:

The authors’ view is that there is a strong need to rethink the driving forces of finance and the economy. Ethical Finance has been at the forefront of exploring new ways of operating that could inspire real change in finance and its rules. We all need this effort to continue and intensify for the sake of our planet and our prosperity.

Stay in touch!

Subscrite to our monthly public newsletter

Copyright 2024 © FEBEA – European Federation of Ethical and Alternative Banks and Financiers

Developed by Implicate.org